PM Kisan Benefits Surrender Complete Process

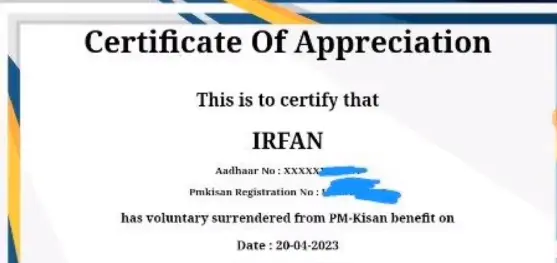

The farmers who are no longer eligible for the PM Kisan Scheme can now voluntarily surrender their PM Kisan benefits using the option of PM Kisan benefits surrender. In return, the farmers will be issued an appreciation certificate from the government.

PM Kisan Scheme is delivering the 14th installment to the scheme’s beneficiaries. Eligible farmers receive 6000 INR in 3 equal installments annually. The amount is paid through the DBT System (Direct Benefit Transfer). However, changes in the occurrence of the beneficiary impact the eligibility data. And it obliged the receiver to surrender the benefits of the PM Kisan scheme.

Therefore, the government has launched a tab on the official website,” PM Kisan Benefits Surrender,” enabling the farmers to withdraw from the scheme. Once surrendered to the benefits applicant will not receive further financial aid. On the other hand, the farmer will receive an appreciation certificate from the government.

Check The Ineligible Beneficiaries List

The farmers paying income tax for a reason immediately becomes ineligible for the PM Kisan Scheme. Furthermore, the Kisan instantly has to either return the payment or voluntarily surrender the benefit of the PM scheme.

However, the ineligible beneficiaries list is updated on the official website. You can download it to check your status before surrendering.

Disqualification Reasons

The PM Kisan scheme is conditioned to criteria. The beneficiaries whose status and data do not match the criteria become immediately ineligible for the scheme. The following are a few reasons that make the beneficiary no longer eligible to receive the payment.

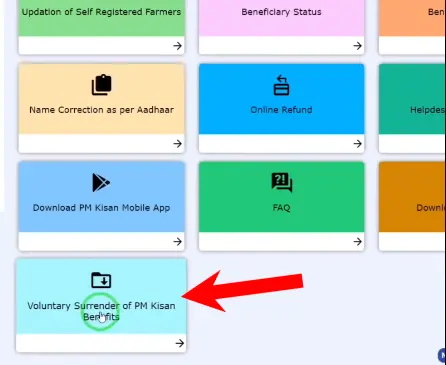

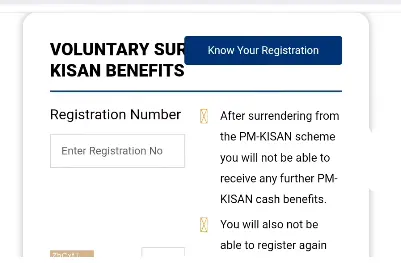

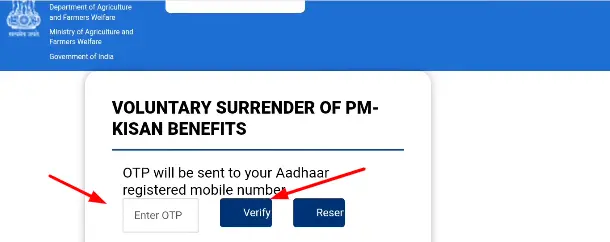

How to Voluntary Surrender PM Kisan Benefits

Farmers are obliged to apply for immediate removal from the PM kisan yojana. The person deliberately disregarding PM Kisan’s benefits surrender may face legal action.

The government has eased the surrender process by adding the PM Kisan benefits surrender tab on the official website. We have shared a detailed method.

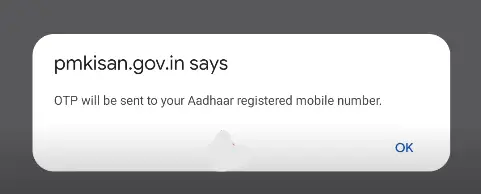

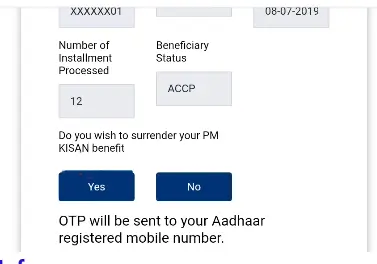

For a better understanding see the screenshots below

Step:1

Step:2

Step:3

Step:4

Step:5

You will receive a certificate of appreciation from the government once done with pm kisan surrender benefits process. (see screenshot below)

Important Note

Surrendering is not a refund of the installments received. Rather it saves you from refunding the installments and legal problems. The beneficiary surrendering to the PM Kisan Scheme is appreciated by the government. Once surrendered, the farmer is only eligible to register again in the scheme if you become eligible according to the criteria given by the government of India.

Refunding the PM Kisan Benefits Due to Income Tax Ineligibility

According to criteria settled by the PM, Kisan Yojana, income taxpayers are not eligible for the scheme’s benefits. The condition is dynamic and may change at any time of the year. Therefore, it’s necessary for the beneficiary to either surrender to PM Kisan benefits or refund the installment received after becoming ineligible. Revering the payment released in the DBT to the authorities is compulsory.

Ineligible beneficiaries will return the payments to the following relevant accounts.

Beneficiary Disqualified Due to Income Tax

Director of Farmers Agriculture

- Acc no: 40903138323

- IFSC: SBIN0006379

Disqualified Due to Other Reasons

Director of Farmers

- Acc number: 4090314046

- IFSC: SBIN0006379

After reversing the payments, one has to submit the UTR to the Agriculture coordinator or district agriculture officer.

Conclusion

The criteria for eligibility in the PM scheme are prone to changes. Therefore, PM scheme officials have taken a step ahead to immediately disqualify the individuals no more meeting the criteria of the beneficiary. Therefore, checking the beneficiary status and immediately surrendering the Pm Kisan scheme benefits after disqualification is important.

FAQS

Why should I Surrender to PM Kisan’s Benefits?

Some farmers received the installments despite becoming ineligible beneficiaries (due to income tax). The receivers were obliged to refund the payment after they had received an installment in their account. To prevent such scenarios, the government added the voluntary surrendering of PM Kisan benefits, preventing the chaos of refunds.

Can I register again after Surrendering to PM Kisan Benefits?

No, the income taxpayer is not eligible to receive the PM Kisan benefits.

How do I surrender to PM Kisan’s benefits through the main office?

You can fill up the form available at the agriculture office/coordinator’s office and attach ITR with the form. The officer will request the removal of the name from the beneficiary list. You will also get the appreciation document from the direct officials.

Абсолютно актуальные новинки индустрии.

Важные мероприятия всемирных подуимов.

Модные дома, торговые марки, высокая мода.

Интересное место для стильныех хайпбистов.

https://stylecross.ru/read/2024-06-19-lacoste-kachestvennyy-premium-po-tsene-mass-marketa/

ok dear

Наиболее стильные новинки мировых подиумов.

Актуальные события мировых подуимов.

Модные дома, бренды, высокая мода.

Интересное место для стильныех людей.

https://world.lepodium.net/

ok

Бренд Vetements можно купить на этом сайте. Аутентичная продукция Ветементс доступна в продаже по выгодным ценам.

Купить оригинальные Vetements

WELLDONE